New Research Dispels Network Effects Myth about High Platform Failure Rates

Contrary to the long-standing belief that platforms fail at higher rates than non-platforms, recent analysis of nearly 5,000 digital health companies reveals that platform businesses successfully raise subsequent funding rounds and exit at higher rates than non-platform businesses.

The world’s most valuable companies are platform businesses. Yet, starting and scaling a platform business is often met with considerable trepidation - by innovators and investors alike. A large amount of this entrepreneurial angst stems from what has become conventional wisdom: that while platform businesses generate the greatest value at scale, they “fail at an alarming rate”. And far more often than non-platform businesses.

However, new research suggests this old platform adage may be more myth than reality - at least in the case of digital health companies.

The Dubious Evidence Against Platforms

The belief that platform companies fail at a high rate is a modern apocryphal tale, something which is often spoken as wisdom and accepted as truth, but without a solid, empirical origin.

While there has been some research into why platforms fail, the basis for claims that platforms fail at a greater rate than non-platforms is not overly compelling or up-to-date. One commonly cited example includes The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power, which makes this assertion based on the analysis of less than 50 platform companies, many operating at the dawn on the internet, between 1995 and 2015.

Dispelling the Platform Failure Myth

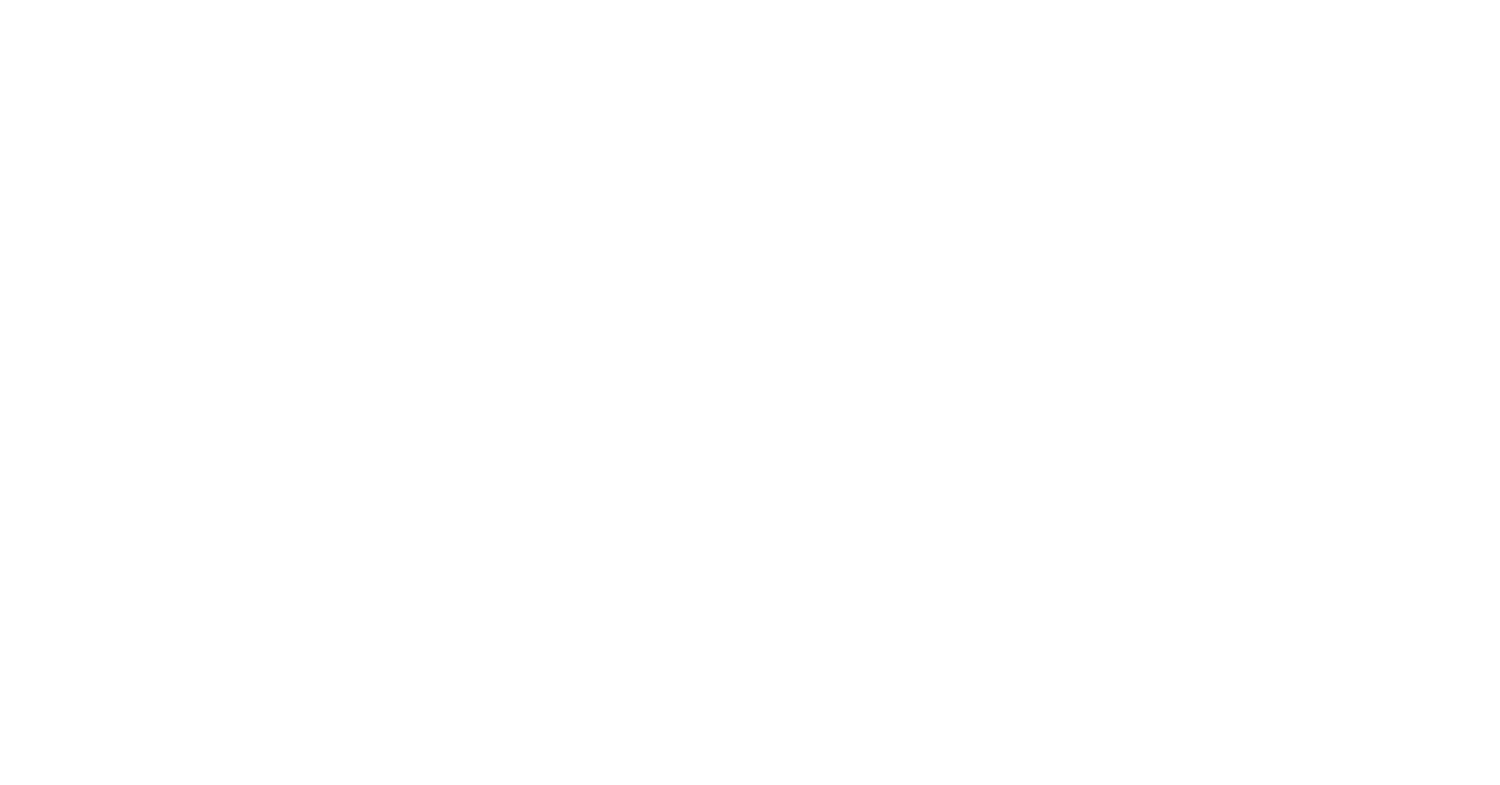

To better understand the validity of this long-held belief, in digital health particularly, Summit Health Advisors analyzed funding data from 4,765 digital health companies from 2016 to 2023.

Startup failure rates can often be difficult to accurately assess, as many shutdowns go unannounced and data in retrospect can be difficult to gather. To address this, Summit Health Advisors analyzed the proportion of digital health companies (platforms and non-platforms) that succeeded in raising subsequent, incremental funding rounds. While not explicitly analyzing startup failure rates, by looking at which companies continue to raise capital and grow, we can make some logical conclusions about the absence of failure - with more reliably reported data (funding data vs shuttering data).

So what did we find?

Platform companies are more successful than non-platform companies at raising follow-on rounds. Of all digital health startups that raised a Seed or Pre-Series A round, 26% of platforms went on to raise a Series A while only 23% of non-platforms did the same. The same kind of drop-offs occurred between Series A and Series B and from Series B to Series C. At all stages, platform companies were more successful at raising subsequent rounds.

Platforms pick up momentum in later stage funding rounds, as their success rate outmatches non-platforms by a greater degree at each stage. For example, platforms are 1.2x more successful at raising a Series A, 1.4x more successful at raising a Series B, and 1.6x more successful at raising a Series C and beyond.

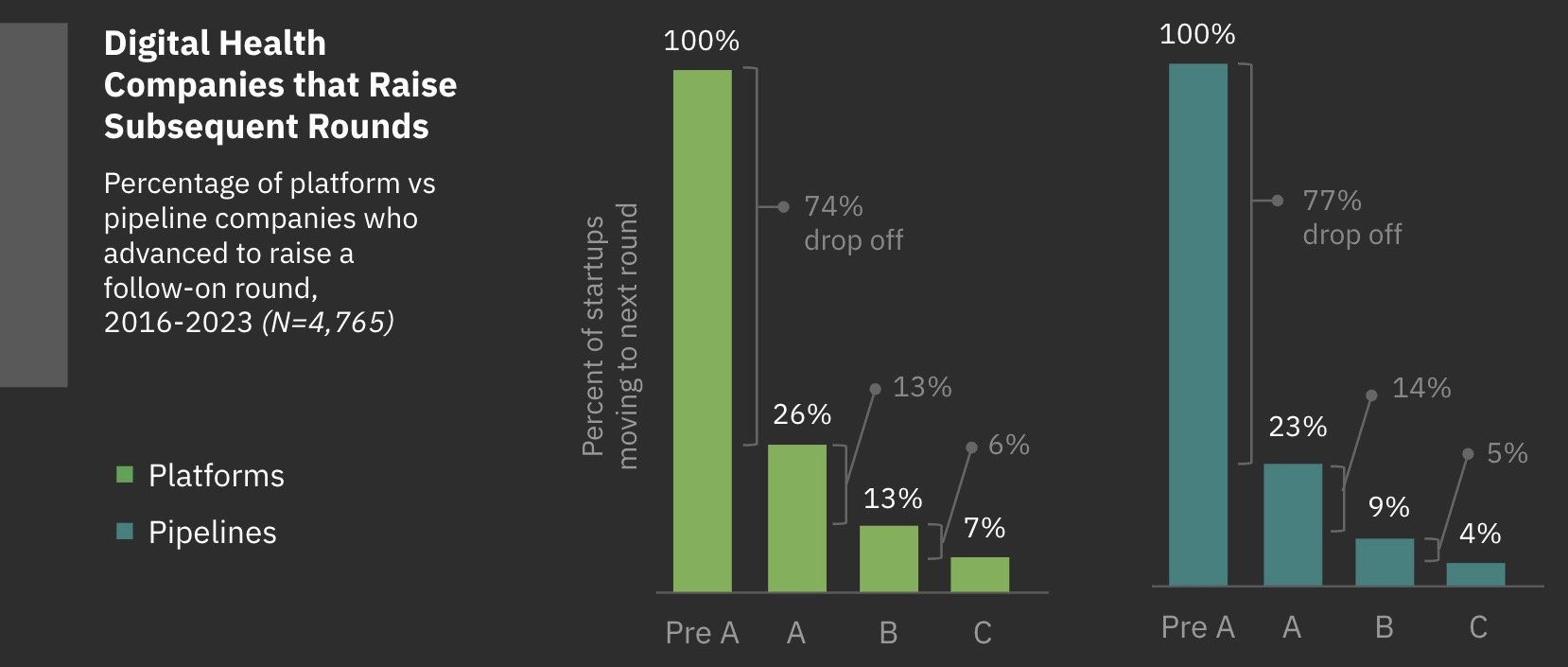

In addition to success in raising capital, it also appears that digital health platform businesses successfully exit at higher rates than non-platform businesses - at least in 2023.

Superior Platform Exit Success

Summit Health Advisors also looked into digital health mergers and acquisitions over the last year. In 2023, platforms represented 35% of digital health mergers and acquisitions, while only making up roughly 20% of all digital health companies.

Therefore, not only do platforms succeed at raising subsequent funding rounds more often than pure software companies, there is also evidence they are acquired at a far higher rate.

Our analysis of platform funding success, deal sizes and valuations all suggest that as platform businesses scale, they outperform non-platforms by greater and greater margins - as their flywheels gather momentum and growth becomes exponential.

Why this All Matters

Some research suggests that up to 98% of health tech businesses fail in the long run, with 60% failing in the first 5 years. And of those that do succeed, the revenue ceiling for software companies in healthcare is quite low compared to other, smaller industries. The barriers to success in digital health are imposing, but platforms may just improve your odds.

So for investors, placing bets on healthcare platform businesses may result in more prosperous and more dependable returns.

For founders, while scaling a platform business in healthcare will certainly be no cakewalk, your risk of failure may not be nearly as great as you think - and, in fact, it might be a key to your success.

To access further insights into the digital health platform market, request our 2024 State of Healthcare Platforms Report.

To access key growth strategies and frameworks for launching and scaling a platform business in healthcare, request our Digital Health Platform Playbook for Startups.