2024 State of Healthcare Platforms Report: The Increasing Dominance of the Platform

Access the latest analysis, trends and insights on the digital health platform landscape. Download the full 2024 State of Healthcare Platforms Report.

While digital health funding dipped once again over the past year, healthcare platforms remain the preeminent business model for healthcare innovation and investment. Over the previous year, healthcare platform companies have once again proven themselves in an inclement economic environment: outperforming their non-platform peers in funding performance (deal size, valuation premium and acquisition success) and business performance (scalability, profitability and shareholder value).

Network effects-driven businesses are uniquely suited to tackle the greatest, and most complex, challenges in healthcare - from enhancing access to data and knowledge, improving utilization of scarce resources, and increasing efficient coordination of care.

As such, it is perhaps no surprise that platforms continue to gain steam as the dominant business model in healthcare.

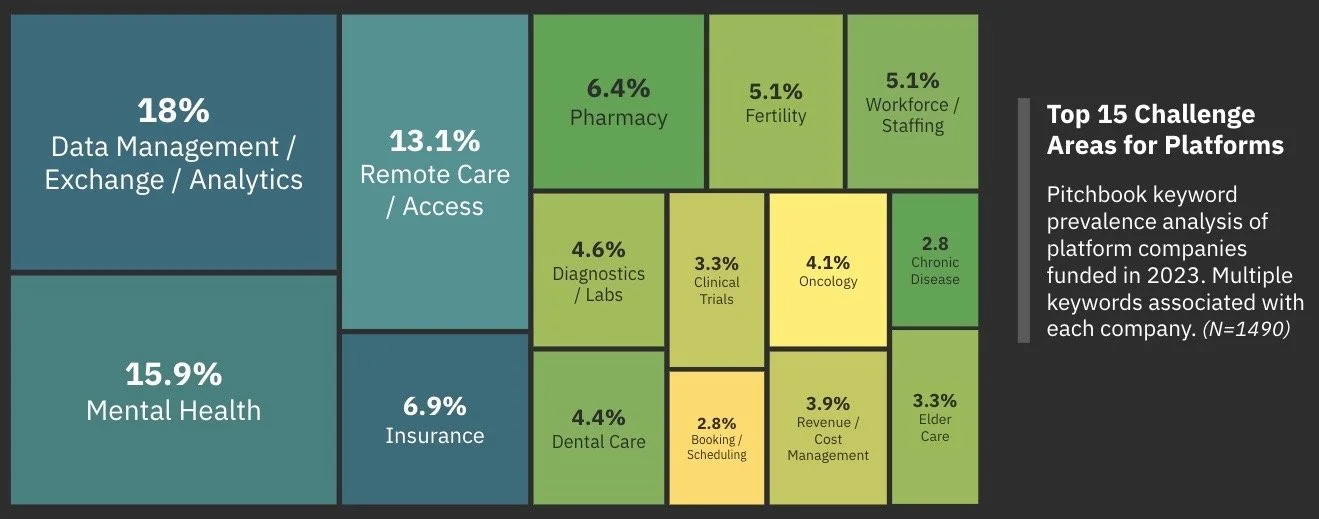

Platforms are tackling the biggest challenges in healthcare

This last year saw platform companies raise capital to tackle some of the most pressing and complex healthcare challenges, with nearly half of companies dedicated, to some degree, towards addressing access to care, mental health, and data management/exchange.

“Healthcare is naturally suited for network effects and platforms. There are just so many disconnected constituents. And so much disconnected data.”

Major platform trends over the last year

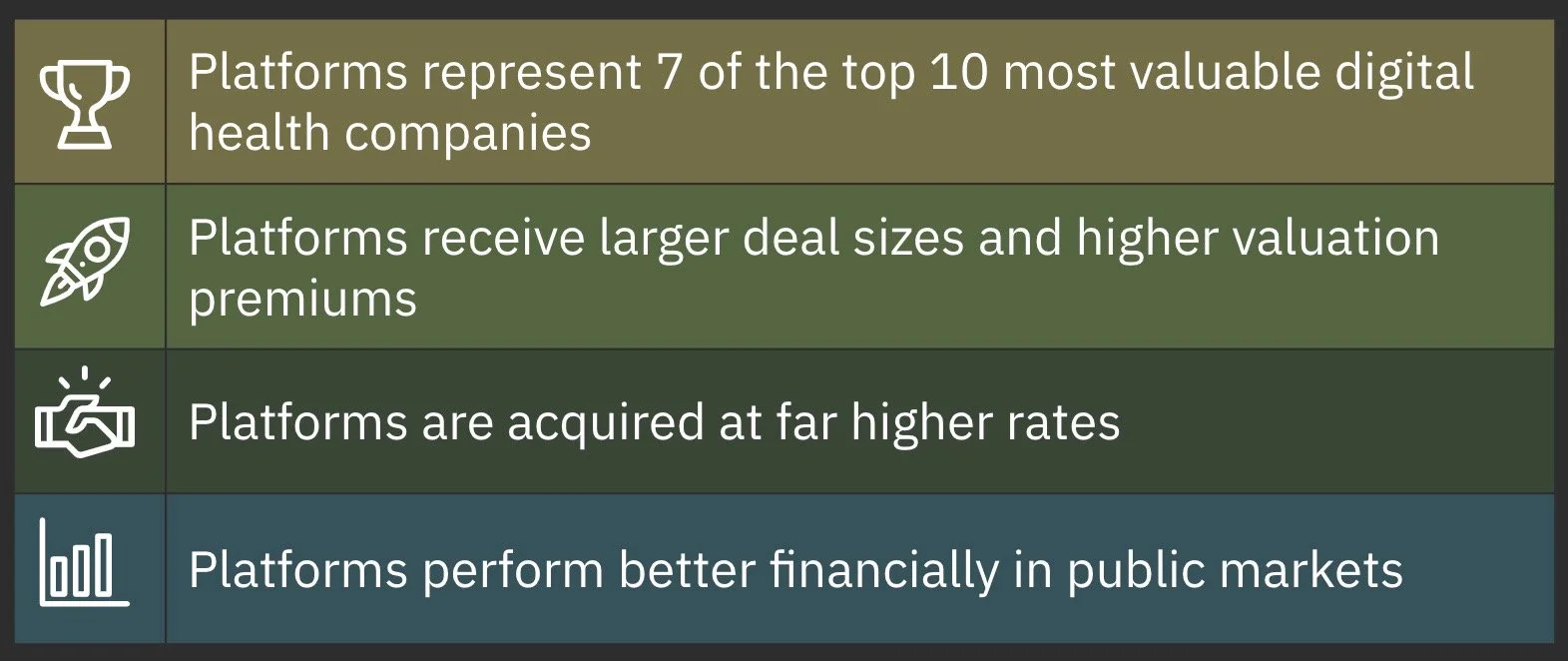

Our analysis reveals that while platform companies received a relatively modest portion of total digital health investment dollars in 2023, they far exceeded their non-platform peers in terms of funding and financial performance.

Further, what the data shows is that as platform companies grow and mature they begin to pull away from their non-platform peers, generally increasing their dominance in Series B and beyond. This trend continues into the public markets, as digital health platforms continue to outperform non-platform in terms of growth, efficiency, profitability and shareholder value.

As platform businesses mature, and their network effects begin to take hold as their flywheel generates momentum, they experience exponential growth and value creation at a pace unmatchable by non-platform companies.

Below are some of the major findings from the report:

Request the 2024 State of Healthcare Platforms Report to access deeper analysis and insights that are driving these trends and shaping the platform landscape.

What platform founders and investors had to say

Building and scaling healthcare platforms is no easy task, especially in a more restrictive funding environment. In our report, leading founders and investors share their perspectives on the evolving funding landscape and advice for those dedicated to building or investing in platform businesses.

While the digital health funding landscape continued to cool in 2023, platform businesses persisted, attracting disproportionately large deals and valuations compared to their non-platform peers. For these innovators and investors, platforms remain an incredibly efficient and defensible business model that will continue to create new value in the transformation of healthcare.

Read the interviews with these platform experts to hear their expertise on:

Seeking Funding | Overcoming common challenges with seeking capital as a platform business

Growing the Network | Attracting new users and sides to the network, and retaining them

Instilling Trust | Building trust with (and between) your community of (often mistrusting) users

Measuring Success | Determining the right platform business metrics, and ensuring alignment between management and investors

“Platforms require a new management paradigm. Above all, investors and founders should be aligned on metrics and timelines. And founders should push back when investors ask for metrics that don’t align with their platform business.”

In 2023, what became clear is that digital health platforms not just outperform their non-platform peers, but that as platform businesses scale, the gap between platforms and non-platforms widens severely - in both private and public markets.

Request the 2024 State of the Healthcare Platforms Report to dive deeper into the latest platform analysis and insights.

If you have any questions about the report or interest in further discussing network effects in healthcare, please reach out to Summit Health Advisors.